Change State is now part of Recruitics! Learn more

Subscribe to get more insights

May arrives with its promise of renewal, but this year it brings something more complex – a strange economic paradox. Like spring flowers pushing through uncertain soil, our labor market continues to show remarkable resilience amid shifting trade policies. April’s surprisingly strong job growth of 177,000 positions demonstrates this tenacity, even as businesses navigate what economists have been calling “tariff turbulence.”

This moment reminds me of a recent sailing adventure. At 10PM on a trip with my now-wife (the wedding was incredible) and father-in-law, our anchor started dragging in rough waters. Rather than panic, we pulled anchor and sailed through the darkness, navigating a narrow channel back to a sheltered cove where we knew we could dock safely.

That experience sure feels similar to our current economic situation – unexpected changes, moments of uncertainty, and the need for quick, clear-headed decisions. Just this week, the U.S. and China announced a 90-day pause on their tariff escalation, dramatically reducing rates from 145% to 30% on Chinese imports, and from 125% to 10% on U.S. goods. Like finding that safe harbor in the night, this brings temporary relief – but with the 90-day clock now ticking, businesses must continue adjusting their courses for whatever conditions emerge next.In these unexpected first five months of the year, flexibility has become a superpower – in business and in life.

Let’s dive into what the numbers are telling us about the current state of the labor market, and what signals might guide us through these uncertain times.

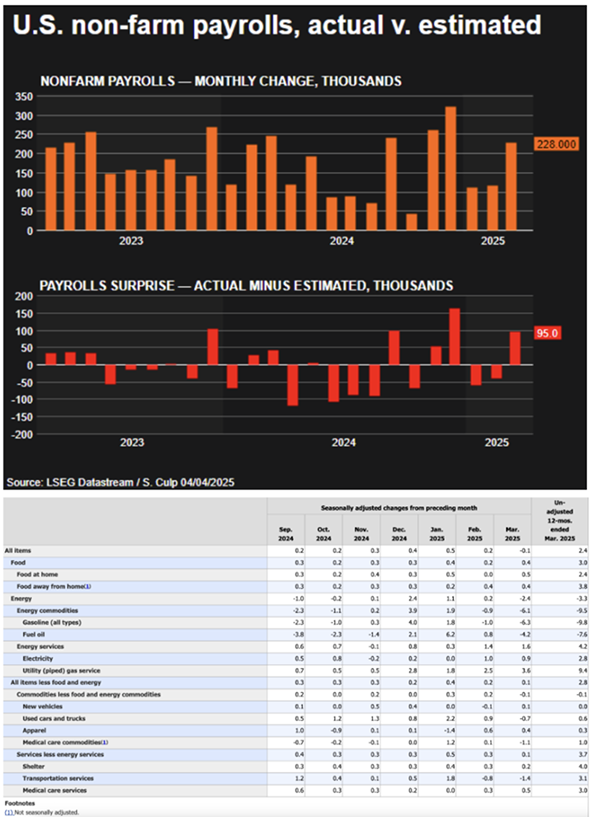

April’s job report reflects a labor market that remains robust despite navigating through significant economic headwinds. Employers added 177,000 jobs last month, surpassing economists’ expectations of 135,000, while the unemployment rate held steady at 4.2% – remaining consistent with the narrow range of 4.0% to 4.2% observed since May 2024.

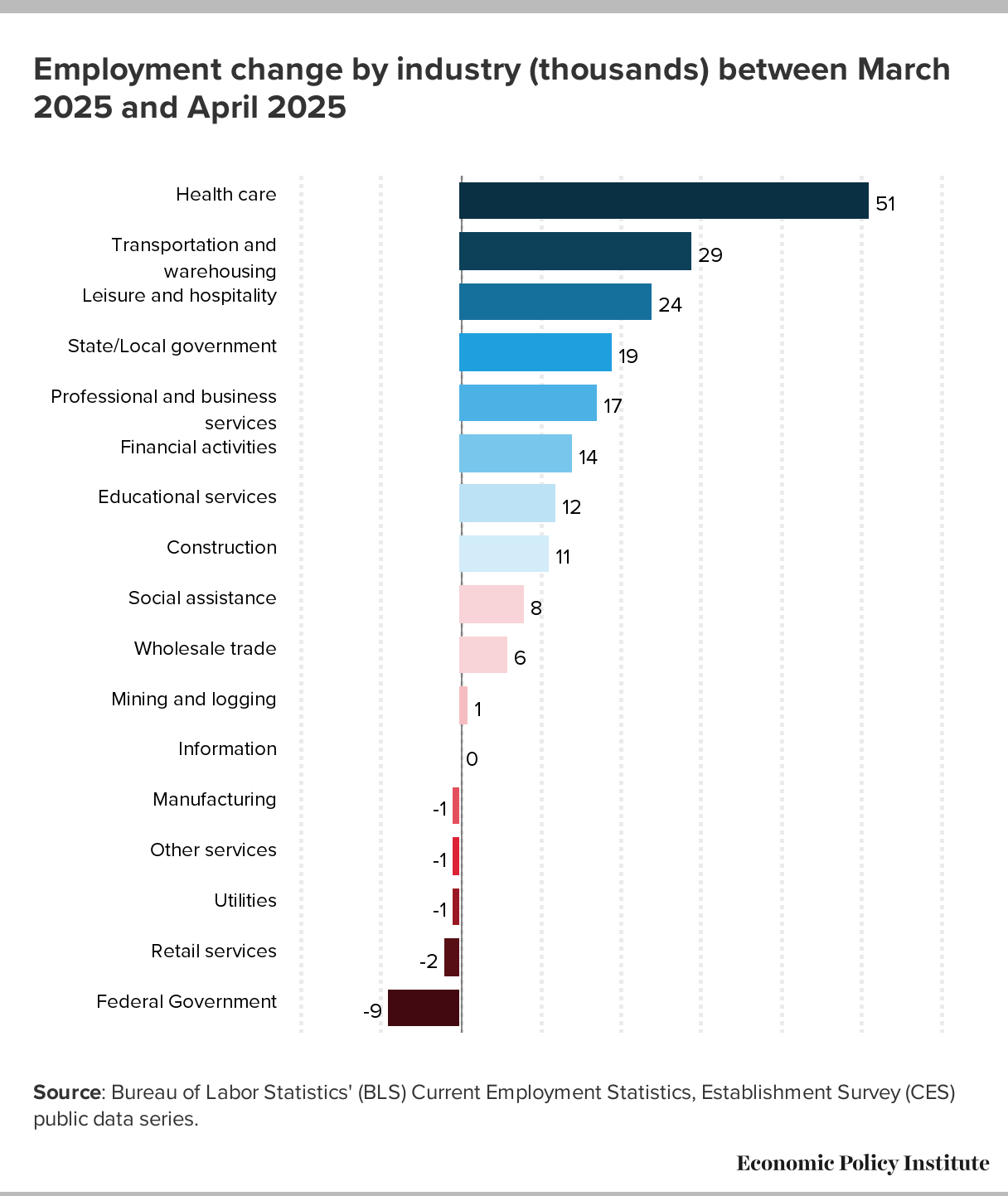

This resilience is particularly remarkable given the economic uncertainty that defined April, with ongoing trade tensions driving market volatility and business apprehension. However, beneath this headline strength, the labor market continues to exhibit a distinct two-track pattern, with some sectors thriving while others struggle to maintain momentum.

Sector Highlights:

Federal Government: Experienced a decline of 9,000 jobs, aligning with ongoing workforce reduction efforts.

Wage growth moderated slightly, with average hourly earnings increasing by 0.2% in April, below expectations of 0.3%. This brings the year-over-year increase to 3.8%, down from 4.0% in March. While wage growth continues to outpace inflation, giving consumers some breathing room, the slowing pace suggests employers may be becoming more cautious about compensation as they navigate economic uncertainty.

Revisions to February and March job figures reduced the previously reported gains by a combined 58,000 jobs. February’s figure was revised down by 15,000 to 102,000, while March was adjusted downward by 43,000 to 185,000. This continues a pattern we’ve observed over the past year, where initial optimism gives way to a more sober reality.

The labor force participation rate ticked higher to 62.6% in April, as 436,000 more Americans reported holding jobs according to the household survey. However, the number of long-term unemployed (those jobless for 27 weeks or more) increased by 179,000 to 1.7 million, accounting for 23.5% of all unemployed people – a concerning trend that bears watching.

January and February’s jobs reports saw significant downward revisions, reducing the previously reported gains by a combined 48,000 jobs. This continues a pattern we’ve observed over the past year, where initial optimism gives way to a more sobering reality.

Average hourly earnings rose by 0.3% in March, bringing the year-over-year increase to 3.8% – outpacing inflation but showing signs of moderation from the 4.0% seen in February. While wage growth has historically supported consumer spending as the primary driver of economic expansion, economists are watching closely for signs that rising prices from tariffs might begin to erode purchasing power and consumer confidence.

The labor market saw 232,000 people enter the workforce in March, a sign of continued confidence among job seekers despite the uncertain economic outlook. This influx of workers contributed to the slight increase in the unemployment rate despite the strong job gains.

Job openings were little changed at 7.6 million in February, according to the latest JOLTS report, but were down by 877,000 over the year. While this remains well above pre-pandemic levels, it’s a significant decline from the peak of job openings seen during the post-pandemic recovery. The job openings rate held at 4.5 percent, while the number of people quitting their jobs was little changed at 3.2 million but down by 273,000 compared to the previous year. These trends suggest a gradual normalization of labor market conditions. March data is scheduled for release in two weeks, which should provide further insight into how the labor market is evolving alongside the strong hiring we saw in March.

The U.S. trade policy continues its roller-coaster trajectory, with the breaking news from Geneva now reshaping economic forecasts. Following the initial shock of April 2’s “Liberation Day” tariff announcement and the subsequent April 9 partial pause, this week brought a major development: a 90-day truce between the U.S. and China announced on May 12. The agreement dramatically drops tariffs on Chinese imports from 145% to 30%, while China reciprocates by reducing its retaliatory duties from 125% to 10% during this negotiation period.

This rapid policy evolution has created substantial uncertainty for businesses and is beginning to impact hiring decisions. According to the First Quarter 2025 CFO Survey from the Richmond Federal Reserve, over 30% of firms now rank trade and tariff policies as their most pressing business concern – more than triple the share from the previous quarter. The same survey revealed that 25% of respondents were planning to reduce hiring in response to tariffs, with this figure rising to 32% among manufacturing firms.

The Budget Lab at Yale University has estimated that the tariffs, even at their reduced levels, could lead to approximately 740,000 job losses by the end of 2025, raising the unemployment rate by 0.6 percentage points. Their analysis suggests the U.S. economy would be 1.1 percentage points smaller as a result of the tariffs, representing approximately $170 billion in annual economic output.

Deloitte shelved their 2025 Q1 CFO survey completely, citing a scrambled economic outlook.

Business leaders are already adjusting strategies, with more than half of manufacturing firms actively diversifying supply chains. Major companies like General Motors have cited tariff impacts in revised financial guidance, with GM estimating a $4-5 billion drag on profits from tariffs this year. These shifting financial forecasts often translate to more conservative hiring plans.

While some protected industries may see isolated job gains, economists broadly expect the net employment effect to be negative. As Ernie Tedeschi, director of economics at the Budget Lab, noted, “The sectors most immediately affected by job cuts are likely to be retail trade, wholesale trade, and manufacturing,” with potential ripple effects throughout the economy.

INFLATION AND CONSUMER SENTIMENT

While April inflation data is scheduled for release on May 14 (tomorrow), the March figures showed surprisingly good news, with the Consumer Price Index decreasing 0.1 percent on a seasonally adjusted basis. The year-over-year increase fell to 2.4 percent, down from 2.8 percent in February, and core inflation (excluding food and energy) rose just 0.1 percent for the month.

However, economists widely expect April’s inflation report to show increased pressure from tariffs. Preliminary estimates suggest a 0.2% increase in the headline CPI and a 0.3% rise in core CPI for April. Manufacturers and retailers have begun warning about price increases in response to higher input costs, with many attempting to absorb some costs while passing others onto consumers.

Consumer sentiment has declined for the fourth consecutive month, with the University of Michigan’s index dropping to 52.2 in April from 57.0 in March – the lowest level since June 2022. One-year inflation expectations have surged to 6.7%, the highest since 1981, reflecting growing concerns about purchasing power amid tariff uncertainty. This pessimism could potentially dampen consumer spending, which has been a primary driver of economic resilience.

FEDERAL RESERVE AND MONETARY POLICY

The Federal Reserve maintained interest rates at their May meeting, consistent with market expectations. Chair Jerome Powell emphasized that the tariff situation creates competing pressures on inflation and growth, noting the measures are “larger than expected” and “the same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

Fed officials find themselves in a particularly challenging position, as tariff-driven inflation might normally call for tighter monetary policy, while slower growth would typically warrant rate cuts. Market expectations for the Fed’s path have become increasingly divided, with federal funds futures markets pricing in the possibility of rate cuts later this year, even as many economists believe officials will need to see clear evidence of labor market deterioration before taking action.

Former Fed Vice Chair Richard Clarida noted that officials “will not be inclined to be pre-emptive to cut rates to avoid what may be a downturn” and will instead “have to see an actual crack in the labor market” before acting. This cautious stance potentially leaves the labor market exposed to greater volatility in the coming months.

What else FOR MAY?

Do you know someone who might like this newsletter? 👉 Tell them about us.

Sources: Bureau of Labor Statistics, Federal Reserve, The Budget Lab at Yale University, University of Michigan, Gallup, LinkedIn Economic Graph, Aspen Institute Future of Work Initiative, Richmond Federal Reserve, CFO Survey, General Motors, McKinsey & Company, Microsoft Research, Economic Policy Institute, Oxford Economics, Bloomberg, The Wall Street Journal, CNBC, Reuters, KPMG, Challenger, Gray & Christmas, New York Post, Business Insider

Software Solutions

Copyright © 2025 Charge State. All rights reserved.

Software Solutions

Copyright © 2025 Charge State. All rights reserved.